Overview of Lendela

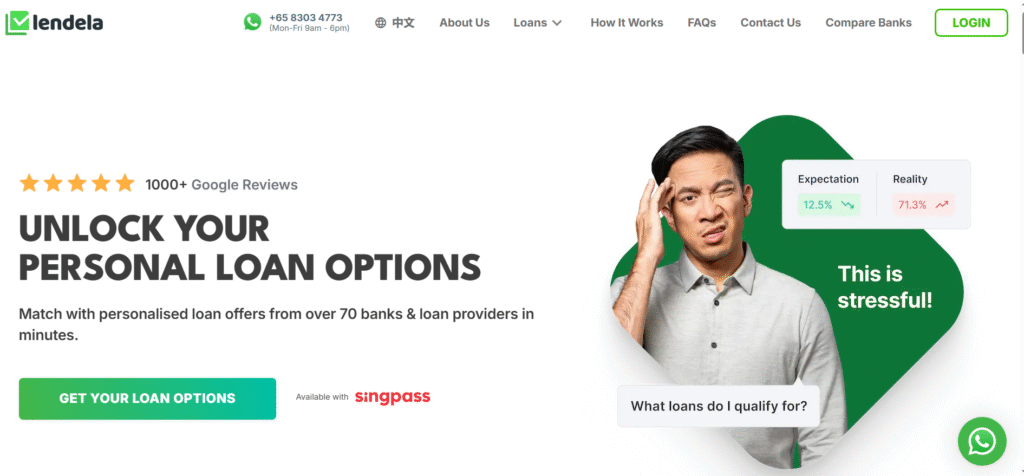

Lendela is a digital loan matchmaking platform founded in 2018, designed to simplify the borrowing process by connecting applicants with personalized loan offers from multiple banks and licensed lenders through a single application. Operating in Singapore, Hong Kong, and Australia, Lendela aims to provide borrowers with transparent and competitive loan options, enhancing financial access across the Asia-Pacific region.

Mission and Vision

Lendela’s mission is to democratize personal loans by offering a transparent, efficient, and user-centric borrowing experience. The platform seeks to empower borrowers by shifting the traditional lending paradigm, allowing financial institutions to compete for customers rather than the other way around.

Unique Features

- Reverse Auction Model: Lendela employs a reverse auction system where lenders compete to offer the best loan terms to applicants. This approach ensures that borrowers receive competitive and personalized loan offers without the need to approach multiple lenders individually.

- Single Application Process: By submitting one application, users can access multiple loan offers, streamlining the borrowing process and saving time.

- Credit Score Protection: Lendela’s process protects users’ credit scores by anonymizing personal Lendela information during the initial matching phase, preventing multiple hard inquiries that can negatively impact credit ratings. Landela

- Free Service: The platform is free to use, with no hidden costs, making it accessible to a broad range of borrowers. Lendela

Partnerships and Reach

Lendela has established partnerships with over 70 banks and licensed loan providers, including prominent institutions such as DBS, HSBC, and Standard Chartered. This extensive network allows the platform to offer a wide array of loan options tailored to individual needs. Lendela

Growth and Recognition

Since its inception, Lendela has facilitated over 400,000 loan applications. In 2023, the company secured an oversubscribed Series A funding round of AUD 7.8 million, led by Singapore-based Chocolate Ventures, to further expand its services across the Asia-Pacific region.

Commitment to Transparency and Data Security

Lendela is committed to maintaining high standards of data security and transparency. The platform ensures that personal information is only shared with lenders after users select a loan offer, and all partner institutions are regulated by relevant financial authorities.

In summary, Lendela stands out as a user-friendly and efficient platform that simplifies the loan application process, offering personalized and competitive loan options while safeguarding users’ credit scores and personal information.

Loan Types Offered by Lendela

Lendela specializes in matching borrowers with a variety of personal loan options tailored to their individual needs. By partnering with multiple banks and licensed financial institutions across Singapore, Hong Kong, and Australia, Lendela provides access to a diverse range of loan products.

1. Unsecured Personal Loans

These are the most common loans facilitated by Lendela. Unsecured personal loans do not require any collateral, making them accessible for purposes such as:

- Debt consolidation

- Home renovations

- Medical expenses

- Travel

- Education

- Major purchases

Borrowers can apply for loan amounts up to 12 times their monthly income, depending on their credit profile and income level. Loan tenures typically range from 12 to 60 months, offering flexibility in repayment. Lendela

2. Secured Personal Loans

For individuals seeking larger loan amounts or more favorable interest rates, Lendela offers secured personal loans. These loans require collateral, such as a vehicle or property, which can result in lower interest rates and higher approval chances. Lendela

3. Debt Consolidation Loans

Lendela assists borrowers in consolidating multiple debts into a single loan with a potentially lower interest rate. This simplifies monthly repayments and can reduce the overall cost of borrowing. The platform’s partnership with Revive Financial in Australia further enhances its ability to provide tailored debt solutions for individuals facing financial distress. The Fintech Times

4. Specialized Personal Loans

Lendela also caters to specific borrower segments by offering specialized personal loans, including: The Fintech Times

- Professional Loans: Tailored for professionals such as doctors, lawyers, and engineers, these loans may come with preferential terms.

- Loans for Women and Farmers: Certain loan plans offer lower interest rates for women and individuals in the agricultural sector, recognizing their unique financial needs. Lendela

5. Flexible Loan Options

Borrowers can choose between fixed-rate and variable-rate loans:Lendela

- Fixed-Rate Loans: Offer consistent monthly repayments throughout the loan tenure, providing predictability in budgeting.

- Variable-Rate Loans: Interest rates may fluctuate based on market conditions, which can be advantageous if rates decrease over time.

Lendela’s platform is designed to provide a seamless and efficient loan matching experience, ensuring that borrowers find the most suitable loan options for their financial situations.

Application Process

Lendela offers a streamlined and user-friendly loan application process, designed to connect borrowers with multiple loan offers through a single application. Here’s a step-by-step guide to how it works:

1. Initial Application

Begin by completing a quick online application form on Lendela’s website. This form requires basic information such as your income, employment status, and desired loan amount. The process is designed to be completed in just a few minutes. Lendela+1Lendela+1specialbae.com

2. Loan Matching

Once submitted, Lendela’s platform forwards your application to its network of partner banks and licensed lenders. Using a reverse auction model, lenders compete to offer you the best loan terms based on your profile. Lendela

3. Receiving Offers

Within a short period, often as little as two minutes, you’ll receive multiple personalized loan offers. These offers will detail the loan amount, interest rates, repayment terms, and any associated fees. Lendelaspecialbae.com

4. Comparing and Selecting Offers

Lendela provides tools to help you compare the received loan offers side by side. You can evaluate each based on your preferences and financial situation, ensuring you select the most suitable option.

5. Document Submission

After selecting a loan offer, you’ll need to submit the required documents for verification. Typically, this includes proof of identity, income verification (such as pay slips or tax returns), and bank statements. Lendela+1Lendela 借得la+1

6. Final Approval and Disbursement

Once your documents are verified, the lender will finalize the loan approval. Upon signing the loan agreement, the funds are disbursed directly to your bank account. The time frame for disbursement can vary but is often completed within a few days. LendelaLendela

Lendela’s process is designed to be efficient and transparent, minimizing the hassle traditionally associated with loan applications. By consolidating multiple loan offers into a single platform, borrowers can make informed decisions quickly and confidently.

Sources

Response 2

Application Process

Lendela streamlines the loan application process, enabling borrowers to access multiple personalized loan offers through a single, user-friendly platform. Here’s a step-by-step guide to how it works:

1. Complete a Quick Online Application

Begin by filling out a simple online form, which takes approximately two minutes to complete. You’ll need to provide basic personal and financial information, such as your income, employment details, and the desired loan amount. In Singapore, you can expedite this process by using Singpass, which allows for secure and efficient data retrieval. Android Apps on Google PlayLendelaAndroid Apps on Google Play+2Lendela+2Lendela+2

2. Receive Tailored Loan Offers

Once your application is submitted, Lendela’s platform anonymizes your personal information and shares the relevant details with its network of over 70 banks and licensed lenders. These institutions assess your profile and present personalized loan offers, typically within minutes. Lendela+1Lendela+1

3. Compare and Select the Best Offer

Review the loan offers based on interest rates, repayment terms, and other conditions. Lendela’s platform allows you to compare these offers side by side, helping you make an informed decision that best suits your financial needs.

4. Finalize the Loan with the Chosen Lender

After selecting the most suitable offer, you’ll proceed to finalize the loan directly with the chosen lender. This may involve submitting additional documentation or undergoing further verification processes as required by the lender.

5. Receive Funds Promptly

Upon approval and completion of all necessary steps, the lender will disburse the loan amount to your designated bank account. The time frame for fund transfer varies depending on the lender’s internal processes, but Lendela aims to facilitate quick and efficient disbursements. Lendela

Eligibility Criteria:

To apply for a loan through Lendela, applicants typically need to meet the following criteria:

- Be at least 21 years old

- Reside in Singapore

- Possess a valid NRIC or FIN

- Provide proof of income, such as pay slips, CPF statements, or tax records Lendela+2ROSHI+2Lendela+2

Lendela’s streamlined application process simplifies borrowing by consolidating multiple loan offers into a single platform, allowing for efficient comparison and selection tailored to your financial requirements.

Sources

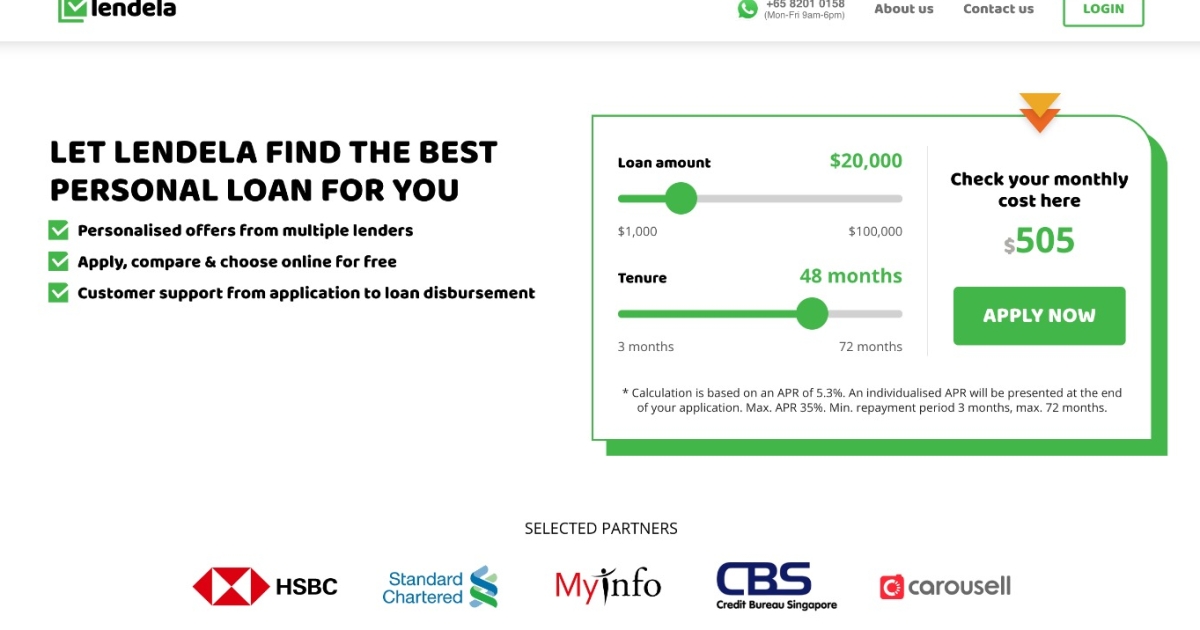

Interest Rates

Lendela’s platform facilitates personal loans with interest rates that vary based on individual creditworthiness, loan amount, and tenure. For instance, a loan amount of $20,000 with an Annual Percentage Rate (APR) of 6.95% over a 5-year tenure results in a total repayment of $26,940, equating to a monthly payment of $449. The maximum APR offered through Lendela is capped at 8.88%, with repayment periods ranging from a minimum of 3 months to a maximum of 72 months .Lendela+1Lendela+1

Fees and Charges

While Lendela’s service is free for borrowers—earning revenue through service fees from partner lenders upon successful loan acceptance —it’s important to consider potential fees associated with the loans themselves:Asian Banking & Finance

- Processing Fees: Some lenders may charge a processing fee, which is typically included in the APR, providing a comprehensive view of the loan’s cost .Lendela

- Late Payment Fees: Failing to make timely repayments can result in additional charges, emphasizing the importance of adhering to the repayment schedule.

- Prepayment Penalties: Certain loans may incur fees for early repayment, so it’s advisable to review the loan terms if you plan to pay off the loan ahead of schedule.

Lendela’s platform simplifies the comparison of different loan offers by taking into account factors like APR, loan tenure, and fees, enabling borrowers to make informed decisions that align with their financial needs and circumstances .Lendela

By providing a single application process that yields multiple personalized loan offers, Lendela empowers borrowers to select the most cost-effective and suitable loan options without impacting their credit scores.

Lender Network and Partners

Lendela collaborates with a diverse network of over 70 banks and licensed financial institutions across Singapore, Hong Kong, and Australia, enabling borrowers to access a wide array of personalized loan options through a single application .Lendela

Notable Banking Partners

In Singapore, Lendela partners with several prominent banks, including:Lendela

- DBS Bank

- POSB

- HSBC

- Standard Chartered Bank

- CIMB Bank

- UOB

- Trust Bank

- GXS BankLendela

These partnerships allow Lendela to offer competitive loan options from established financial institutions .

Licensed Moneylender Collaborations

Beyond traditional banks, Lendela also collaborates with reputable licensed moneylenders to provide borrowers with alternative financing options. Notable partners include:

- Accredit

- IFS Capital

- MinterestAsian Banking & Finance

These collaborations expand the range of loan products available to borrowers, catering to various financial needs and credit profiles .Asian Banking & Finance

Australian Lending Partners

In Australia, Lendela’s network includes a variety of recognized lenders, such as:

- Plenti

- NOW Finance

- Revolut

- OurMoneyMarket

- Wisr

- MoneyMe

- Fair Go FinanceLendela

These partnerships enable Australian borrowers to access personalized loan offers from a broad spectrum of financial institutions .Lendela

Benefits of Lendela’s Partner Network

- Comprehensive Loan Options: By partnering with a wide range of banks and licensed lenders, Lendela provides borrowers with diverse loan products tailored to various financial situations.

- Competitive Offers: The extensive network fosters competition among lenders, potentially leading to more favorable interest rates and terms for borrowers.

- Streamlined Application Process: Borrowers can receive multiple loan offers through a single application, simplifying the loan comparison and selection process.

Lendela’s expansive lender network is instrumental in delivering a seamless and efficient borrowing experience, offering users access to a multitude of loan options suited to their unique financial needs.

Loan Approval Time

Lendela is renowned for its swift and efficient loan approval process, designed to meet the urgent financial needs of borrowers in Singapore. Here’s an overview of the typical timeline:

1. Application Submission (2 Minutes)

The process begins with a quick online application, which can be completed in as little as two minutes using Singpass. This method automatically retrieves necessary information such as income statements, residential address, and CPF contribution history, streamlining the application process. Lendela+2Lendela+2Android Apps on Google Play+2

2. Receiving Loan Offers (As Fast As 2 Minutes)

Upon submission, Lendela’s matching engine rapidly processes the application, providing personalized loan offers from over 50 banks and licensed lenders. Borrowers can receive these offers in as little as two minutes, allowing for immediate comparison and selection. Lendela

3. Loan Disbursement (As Fast As 15 Minutes)

After accepting a loan offer from a bank, funds can be disbursed to the borrower’s account in as little as 15 minutes. For offers from non-bank providers, Singapore regulations require borrowers to physically verify their identities at the lender’s office, after which the funds are released. Lendela

4. Overall Timeline

From application to fund disbursement, the entire process can be completed within a few hours, depending on the lender and the borrower’s responsiveness. This rapid turnaround is particularly beneficial for those seeking immediate financial assistance.

Lendela’s expedited loan approval process underscores its commitment to providing quick and accessible financial solutions, ensuring that borrowers can address their financial needs promptly and efficiently.

Credit Score Requirements

In Singapore, credit scores range from 1,000 to 2,000, with higher scores indicating better creditworthiness. While Lendela does not perform credit checks themselves, they match borrowers with lenders who do consider credit scores as part of their assessment process. A higher credit score increases your chances of loan approval and securing favorable interest rates. Lendela+4Lendela+4Lendela+4

Understanding Credit Scores

The Credit Bureau Singapore (CBS) assigns credit scores based on various factors, including:Lendela+2Lendela+2Lendela+2

- Credit Amount: The total amount of credit you owe or use on accounts.Lendela

- Recent Credit: Frequent applications for credit in a short time can negatively impact your score.

- Late Repayment Information: Late payments on current loans can lower your credit score.Lendela

- Credit History: A long and established credit history with timely repayments can enhance your score.Lendela

- Available Credit: The number of active credit accounts you have.Lendela+1Lendela+1

- Number of Credit Applications: Multiple credit applications can be viewed as a red flag by lenders. Lendela+1Lendela+1

Eligibility Criteria

To apply for a personal loan through Lendela in Singapore, you should meet the following criteria:

- Age: Between 21 and 61 years old.Lendela

- Income: A minimum monthly income of $1,600.Lendela+1Lendela+1

- Residency: Singaporean citizens, permanent residents, and Employment Pass holders are eligible.Lendela

- Employment: Stable employment or self-employment status. Lendela

Improving Your Credit Score

If your credit score is lower than desired, consider the following steps to improve it:

- Check Your Credit Report: Regularly review your credit report for errors and rectify them promptly.

- Timely Payments: Ensure all bills and loan repayments are made on time.

- Manage Credit Utilization: Keep your credit card balances low relative to your credit limits.Lendela

- Limit New Credit Applications: Avoid applying for multiple credit lines in a short period.Lendela

- Diversify Credit Types: Having a mix of credit types can positively influence your score. Lendela

By understanding and managing your credit score effectively, you can enhance your eligibility for personal loans and secure better loan terms through platforms like Lendela.

Customer Support

Lendela is committed to providing exceptional customer support to ensure a seamless loan application experience for its users. Whether you’re seeking assistance with your application or have inquiries about loan offers, Lendela’s support team is readily available to help.

Contact Information

For borrowers in Singapore, Lendela offers multiple channels to reach their customer support team:

- WhatsApp: +65 8303 4773

- Phone: +65 6964 0636

- Email: contact@lendela.com

- Address: Lendela Pte. Ltd., 176 Orchard Road, #05-05, Singapore 238843 Lendela+3Lendela+3Log in or sign up to view+3LinkedIn+6Lendela+6Lendela+6

The support team is available from Monday to Friday, 9:00 AM to 6:00 PM (SGT).

Support Services

Lendela’s customer support team assists users throughout the loan application process, including:

- Guiding applicants through the online application steps

- Clarifying loan offer details and terms

- Addressing any issues or concerns promptly

- Providing personalized assistance to match borrowers with suitable loan options

Their commitment to responsive and helpful service has been recognized by users, contributing to a positive borrowing experience.

For more information or to get in touch with Lendela’s customer support, visit their Contact Us page.

User Reviews and Reputation

Lendela has garnered a strong reputation as a trustworthy and efficient loan comparison platform in Singapore, with numerous positive reviews from both users and employees.

⭐ User Feedback

Lendela’s users consistently praise the platform for its user-friendly interface and prompt service. Many borrowers have reported receiving multiple loan offers within minutes of applying, highlighting the platform’s efficiency. For instance, one user shared, “I applied and within minutes I received at least 10 offers.” Another commented on the excellent customer support, stating, “Thanks Dharan for helping me to search and follow up during this period. Very well assisting and services.” Lendela

On Google, Lendela boasts over 500 reviews with an impressive average rating of 4.9 out of 5 stars, underscoring its commitment to customer satisfaction. Instagram

🏢 Employee Insights

From an employer’s perspective, Lendela maintains a positive work environment. According to Glassdoor, the company holds a 4.2 out of 5 rating, with 77% of employees recommending it to others. This reflects a supportive workplace culture and effective leadership. Glassdoor+1Glassdoor+1

🔒 Trust and Security

Lendela is recognized as a legitimate and secure platform operating within Singapore’s legal framework. The company partners exclusively with licensed banks and financial institutions, ensuring borrowers are protected from unlicensed lenders. Additionally, Lendela employs advanced encryption technologies to safeguard user data, aligning with international best practices for data security. ScamAdviser+3Lendela+3ROSHI+3Lendela

🏆 Industry Recognition

Lendela has been featured in reputable publications such as The Straits Times, Today, and Singapore Business Review, further cementing its status as a leading fintech company in Singapore. Lendela

In summary, Lendela’s combination of positive user experiences, supportive employee feedback, stringent security measures, and industry recognition positions it as a reliable and reputable choice for individuals seeking personal loans in Singapore.

🔐 Security and Data Privacy at Lendela

Lendela prioritizes the security and confidentiality of your personal information throughout the loan application process. As a licensed financial technology platform regulated by the Monetary Authority of Singapore (MAS), Lendela adheres to stringent data protection laws to ensure your data is handled responsibly.

🛡️ Data Protection Measures

- Anonymized Matching Process: When you apply through Lendela, your personal details are anonymized during the matching process. This means that banks and financial institutions can assess your application and provide personalized loan offers without accessing your full personal information until you’ve selected an offer. Lendela

- Secure Data Transmission: Lendela employs advanced encryption technologies to protect your data during transmission. This ensures that your personal and financial information remains secure from unauthorized access.

- Integration with Singpass: In Singapore, Lendela utilizes Singpass, the government’s digital identity system, to streamline the loan application process. This integration enhances data accuracy and security by reducing manual data entry and potential errors. connectid.com.au+1Identity Week+1

🔄 Data Sharing and Usage

- Limited Data Sharing: Lendela shares your personal information only with the financial institutions necessary to generate personalized loan offers. Your data is not sold or shared with third parties for marketing purposes without your explicit consent. Lendela

- Retention Policy: Personal data is retained only as long as necessary to fulfill the purposes outlined in Lendela’s privacy policy and in accordance with applicable laws and regulations. Lendela

✅ Regulatory Compliance

Lendela operates in compliance with Singapore’s data protection laws, including the Personal Data Protection Act (PDPA). All partner banks and financial institutions are also required to adhere to these regulations, ensuring a consistent standard of data protection across the platform. Lendela

For more detailed information on how Lendela protects your data, you can visit their Privacy Policy.

In summary, Lendela employs robust security measures and complies with regulatory standards to safeguard your personal information, providing a secure environment for your loan application process.

📱 Mobile and Web Experience at Lendela

Lendela offers a seamless digital experience for borrowers in Singapore, providing both a user-friendly mobile app and an intuitive web platform. These platforms are designed to simplify the loan application process, ensuring accessibility and efficiency.

📲 Mobile App

- Availability: The Lendela mobile app is available for download on the Google Play Store. Android Apps on Google Play

- User Interface: The app features a clean, green-themed interface that aligns with Lendela’s branding. Users can easily navigate through the application process, which is streamlined for quick access.

- Functionality: Borrowers can apply for loans, receive personalized offers from over 50 banks and licensed providers, and track their application status—all within the app. Android Apps on Google Play

💻 Web Platform

- Accessibility: The Lendela website is accessible at sg.lendela.com, providing a comprehensive overview of their services.

- Features: Users can compare loan options, understand eligibility criteria, and access educational resources about personal loans. The platform also offers a loan calculator to help borrowers estimate monthly repayments.

- Singpass Integration: For Singaporean citizens and permanent residents, Lendela integrates with Singpass, allowing for a secure and efficient application process.

✅ Overall Experience

Both the mobile app and web platform are designed to provide a transparent and user-centric loan application experience. Lendela’s commitment to simplicity and efficiency ensures that borrowers can make informed decisions without the complexities traditionally associated with loan applications.

Whether accessing via mobile or desktop, Lendela offers a consistent and reliable service, empowering users to find the best loan options tailored to their needs.

Sources

4o mini

🔍 Comparison of Lendela with Competitors in Singapore

When seeking personal loans in Singapore, several platforms offer comparison services. Here’s how Lendela stands out compared to others:

1. Lendela

- Model: Loan matching platform that connects borrowers with multiple banks and licensed loan providers through a single application.Lendela

- Process: Utilizes Singpass for secure and efficient applications, providing personalized loan offers with transparent interest rates and fees. Lendela

- Advantages:

- Anonymized matching process to protect credit scores.

- Quick loan disbursement, often within a day or two.

- Supports borrowers with varying credit scores.Lendela

- Limitations:

- Currently, no dedicated mobile app; users access services via the web platform.

2. SingSaver

- Model: Comparison site offering a range of financial products, including personal loans.

- Process: Provides a platform to compare interest rates, fees, and terms from various banks and financial institutions.

- Advantages:

- Established platform with a broad range of financial products.

- Offers cashback promotions for successful applications.

- Limitations:

- May not provide personalized loan matching.

- Users need to apply individually to each bank, potentially impacting credit scores.

3. MoneySmart

- Model: Financial comparison site with a focus on simplifying complex financial concepts.personal.lendingpot.sg

- Process: Allows users to compare personal loans, credit cards, insurance, and other financial products.personal.lendingpot.sg

- Advantages:

- User-friendly interface with clear information.

- Provides a variety of financial products for comparison.personal.lendingpot.sg+1Lendela+1

- Limitations:

- Like SingSaver, may require users to apply individually to each bank.

- Limited personalized loan matching services.Lendela+1Lendela+1

📊 Feature Comparison Table

| Feature | Lendela | SingSaver | MoneySmart |

|---|---|---|---|

| Personalized Loan Matching | ✅ Yes | ❌ No | ❌ No |

| Single Application | ✅ Yes | ❌ No | ❌ No |

| Credit Score Protection | ✅ Yes | ❌ No | ❌ No |

| Quick Loan Disbursement | ✅ Yes | ❌ Varies by bank | ❌ Varies by bank |

| Cashback Promotions | ❌ No | ✅ Yes | ✅ Yes |

| Mobile App | ❌ No | ✅ Yes | ✅ Yes |

✅ Conclusion

For borrowers seeking a streamlined and secure loan application process with personalized offers, Lendela offers significant advantages. Its anonymized matching system and quick loan disbursement make it a compelling choice. However, if you’re interested in cashback promotions and a broader range of financial products, platforms like SingSaver and MoneySmart might also be worth considering.

Ultimately, the best platform depends on your specific needs and preferences.